will capital gains tax increase in 2021

We will look at the tax rates from 2021 to 2022 and hope that these will inspire us to fathom the projections for the next year as well. Apr 23 2021 305 AM.

What You Need To Know About Capital Gains Tax

Capital Gains Tax Rates for 2021.

. As proposed the rate hike is already in effect for sales after April 28 2021. This would take effect in 2022. Does capital gains increase basis.

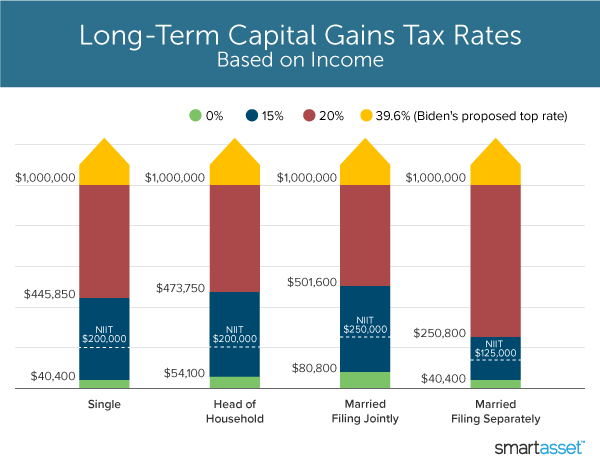

Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said. The current tax preference for capital gains costs upwards of 15 billion annually.

Short term capital gains tax applies to certain investments sold at a profit. These taxpayers would have to pay a tax rate of 396 on long-term capital gains. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. The IRS taxes short-term capital gains like ordinary income. 35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for people earning over 400000 or those in the highest tax bracket.

Those with less income dont pay any taxes. This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax bracket rate of 37. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased. The effective date for this increase would be September 13 2021.

Then you will pay a long-term capital gains tax of 10 to 20 depending on your tax bracket on the entire sale amount. Posted on January 7 2021 by Michael Smart. The maximum capital gains are taxed would also increase.

But because the higher tax rate as proposed would only. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. Its important to note that Biden is also proposing a tax hikethat will raise the top income tax bracket from 37 to 396.

If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in. By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED. Request a Payment Trace.

Married couples filing jointly. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

The 238 rate may go to 434 an 82 increase. The first 500000 of the gain is tax-free and the remaining 275000 is subject to capital gains tax rates of 15 or 20 depending on your income plus a 38 surtax for upper-income individuals. This tax increase applies to high-income individuals with an AGI of more than 1 million.

Add state taxes and you may be well over 50. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Its time to increase taxes on capital gains. Will capital gains go up in 2021.

Short-Term Capital Gains Tax Rates 2021. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Note that short-term capital gains taxes are even higher.

Alternatively you can estimate the initial price of the share. Proposed capital gains tax. Short-term gains are taxed as ordinary income.

Capital gains tax rates on most assets held for a year or less correspond to. Learn how short term capital gains are taxed for 2022 and 2021. The bottom 99 on.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

What You Need To Know About Capital Gains Tax

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax What Is It When Do You Pay It

The Tax Impact Of The Long Term Capital Gains Bump Zone

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What It Is How It Works Seeking Alpha

What You Need To Know About Capital Gains Tax

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

What S In Biden S Capital Gains Tax Plan Smartasset

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)